Money in Online Payment Apps are not Protected

According to a recent Consumer Reports survey, (P2P-Report-4-Surveys-2022.pdf (consumerreports.org), 40% of Americans have used an online payment application such as Venmo, PayPal, Apple Pay, Google Pay or Zelle. The industry term for these applications is a Peer-to-Peer, or PTP app. These services allow consumers to send or receive money directly without using a credit card, check or cash. Many consumers like the convenience of being able to easily split a restaurant bill, pay for an online purchase, or reimburse friends for activities.

As we highlighted in a prior blog, these apps do little to protect you if you fall victim to a scam and inadvertently send money through one of these PTP apps to a bad actor. In most cases, you will not recover those funds.

It is very important to also realize that while money held in a bank or credit union account is insured by the FDIC for up to $250,000, funds stored inside of these PTP apps are not FDIC insured. Your payment app company might invest your money, earn money on those investments, and pay no interest to you. If the payment app company loses money on those investments, your money may be at risk.

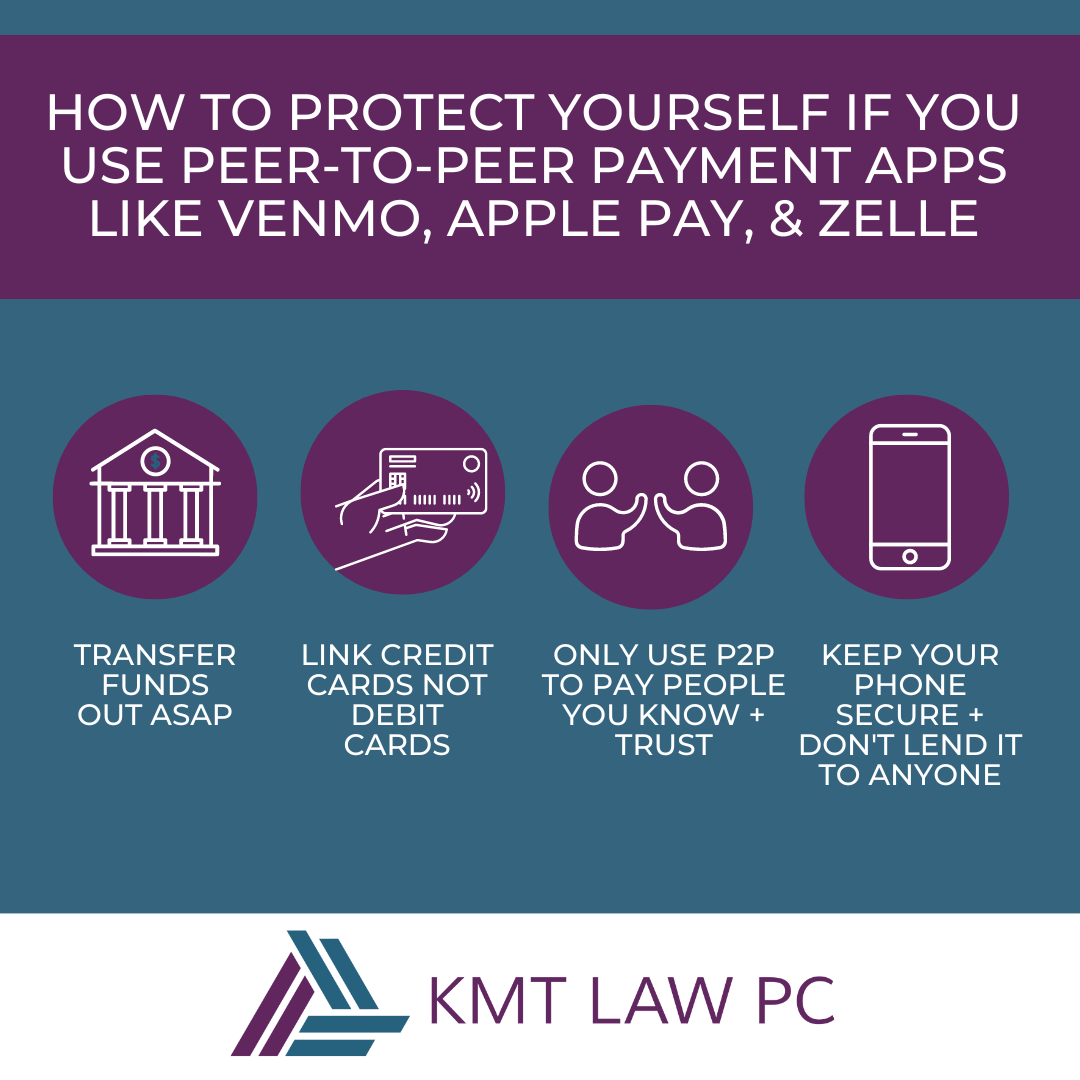

How to Protect Yourself:

Regularly transfer your funds back to your FDIC insured account.

Consider linking your credit card instead of your debit card to your P2P app, which may provide more protection in case of fraud.

Only use P2P to pay people you know and trust. And keep your app up to date with potential security fixes.

Don’t let anyone borrow your phone or take your photo – they could quickly access your P2P app and send money out.